Available in Candescent's Marketplace

Earned Wage Access Integrated into Candescent

Clockout brings Embedded Earned Wage Access to Candescent digital banking environments. Designed for Candescent financial institutions, Clockout deploys natively within your mobile banking experience, helping banks and credit unions deliver on-demand pay, capture core deposits, and compete with fintech apps through a fully white-labeled solution.

Simple Integration

Integrate EWA into Candescent mobile Banking

Clockout® embeds effortlessly into your existing mobile and online banking platforms.

1

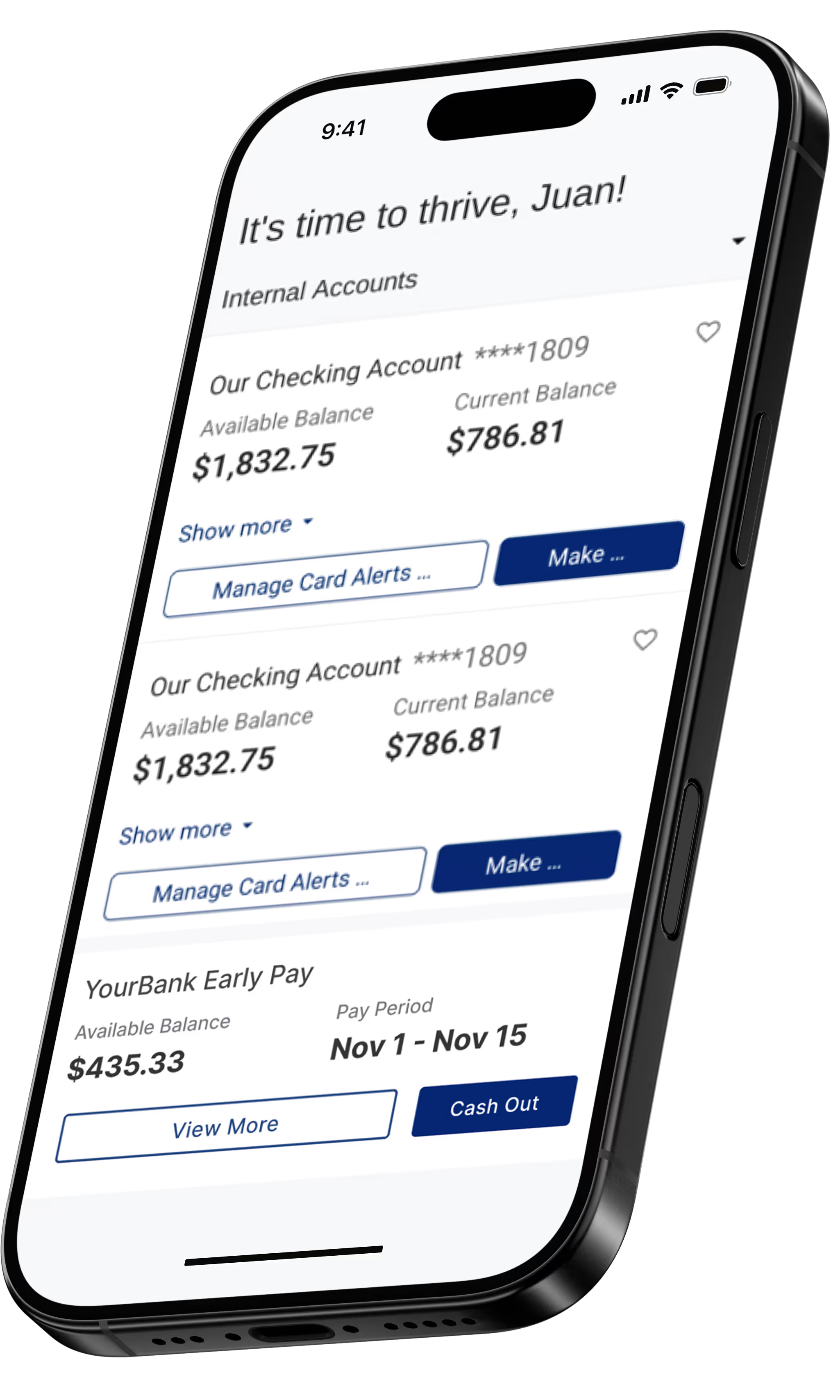

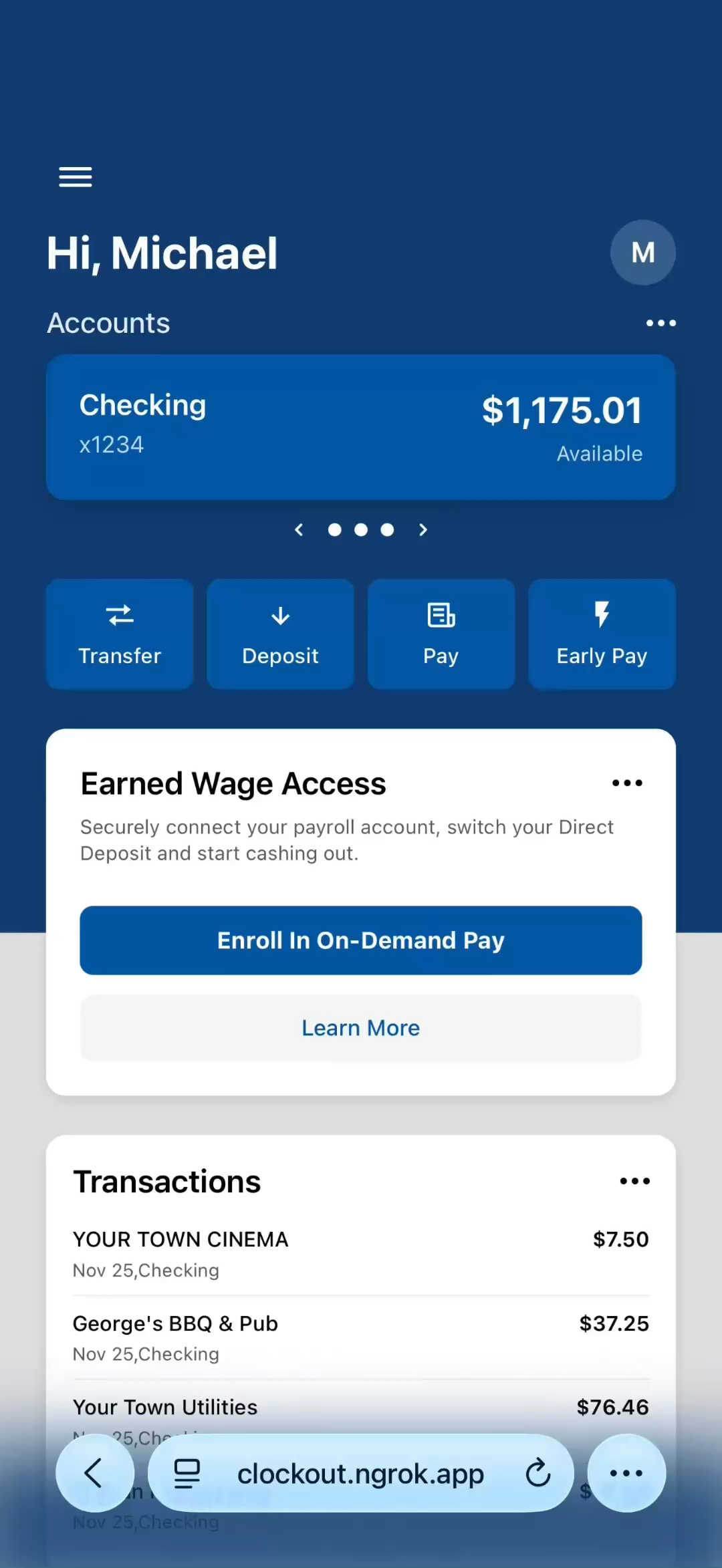

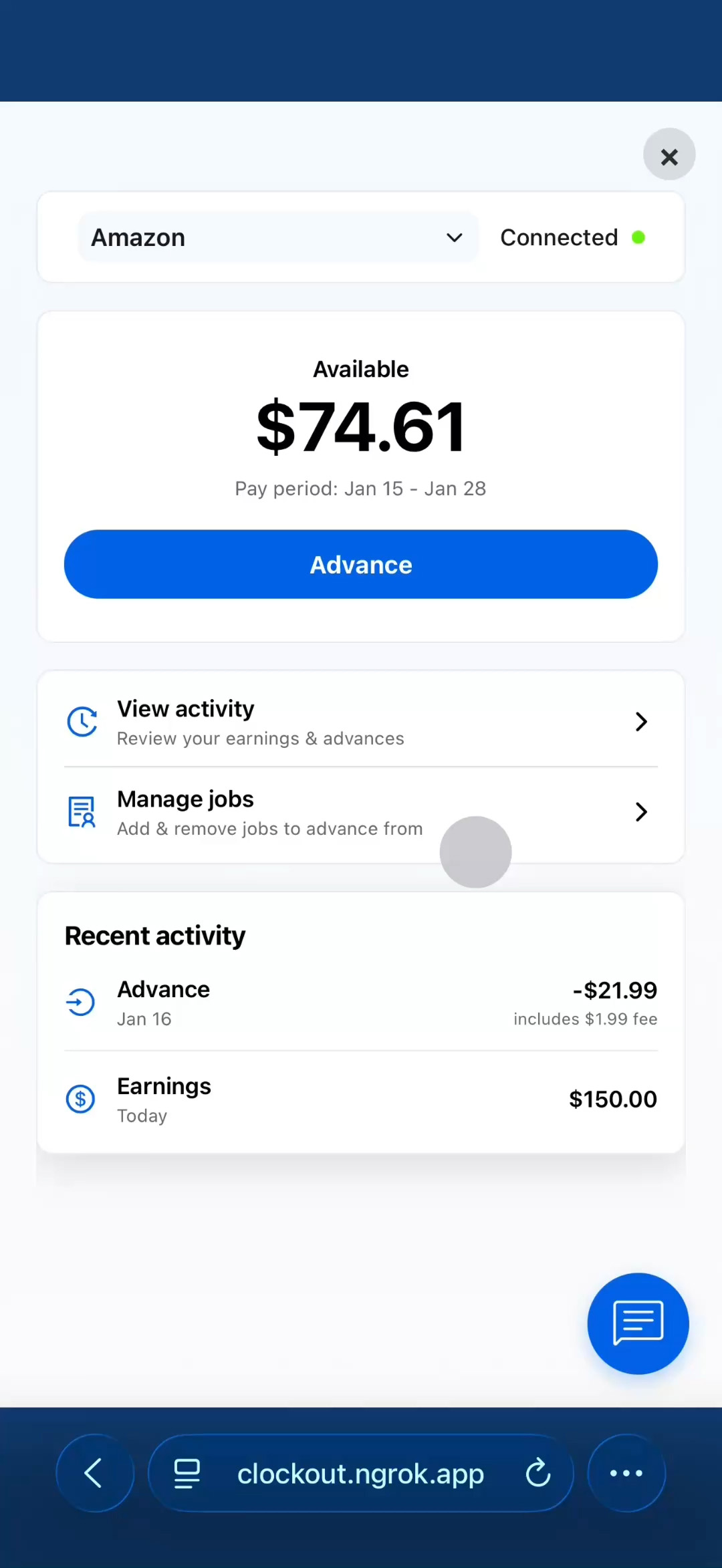

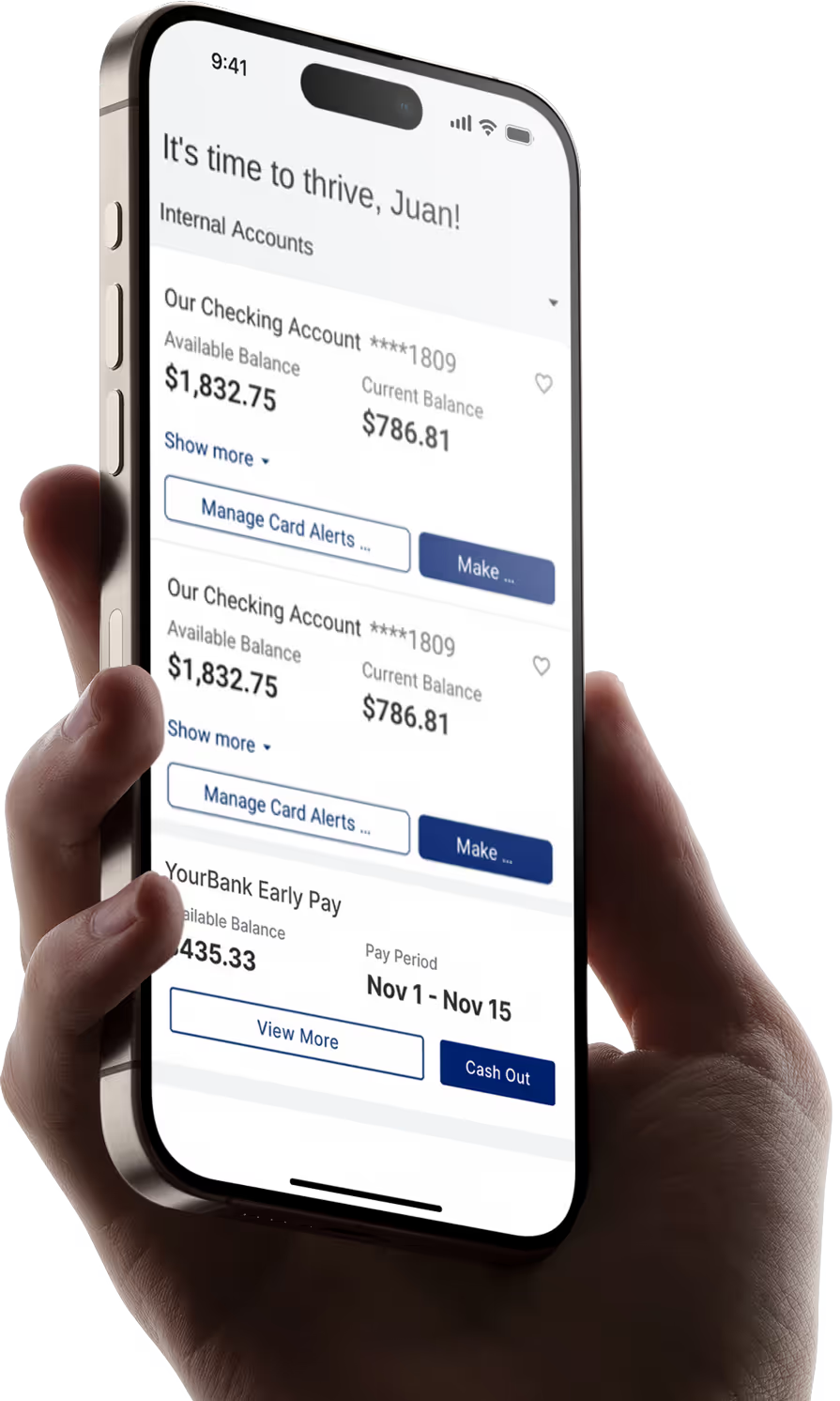

Access in Mobile Banking

Embedded directly within your bank’s mobile and online banking experience.

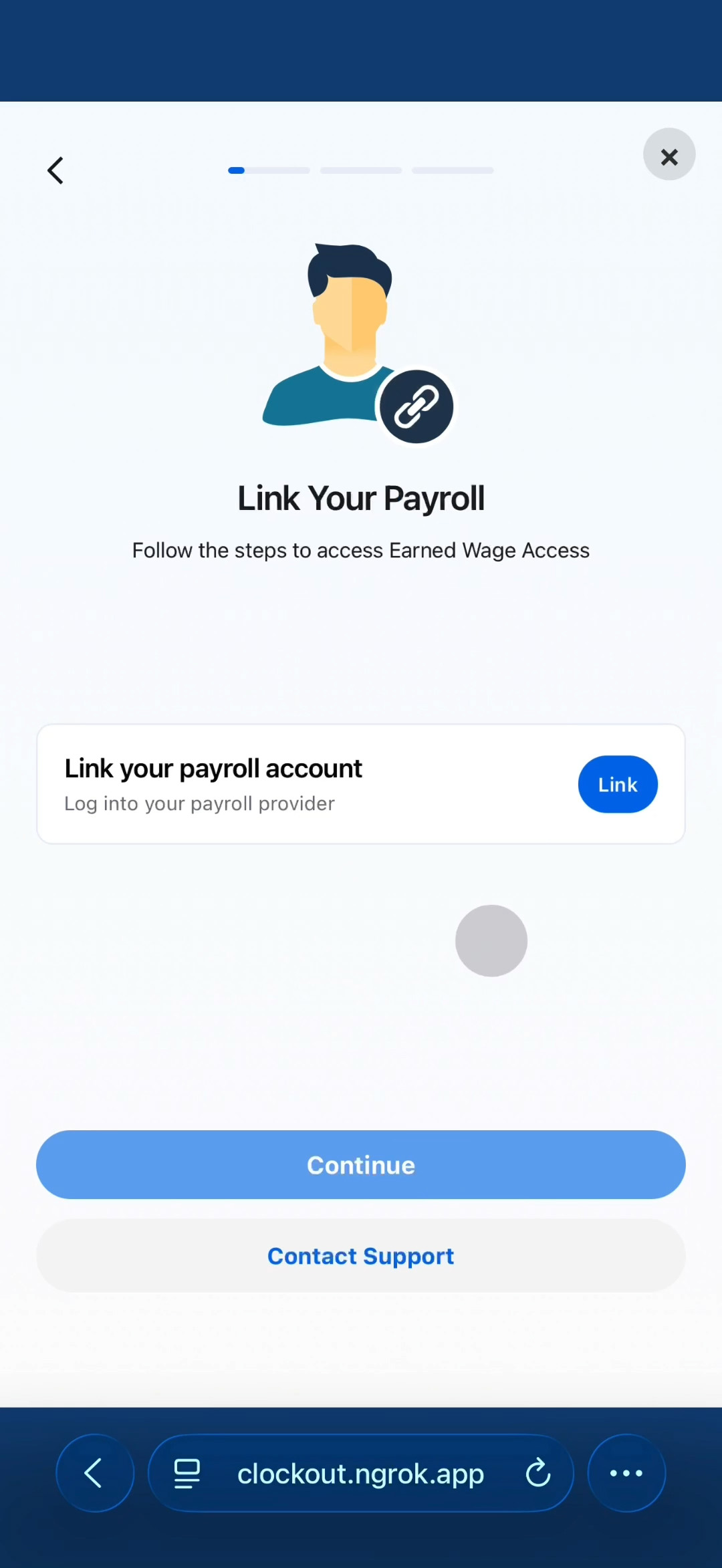

2

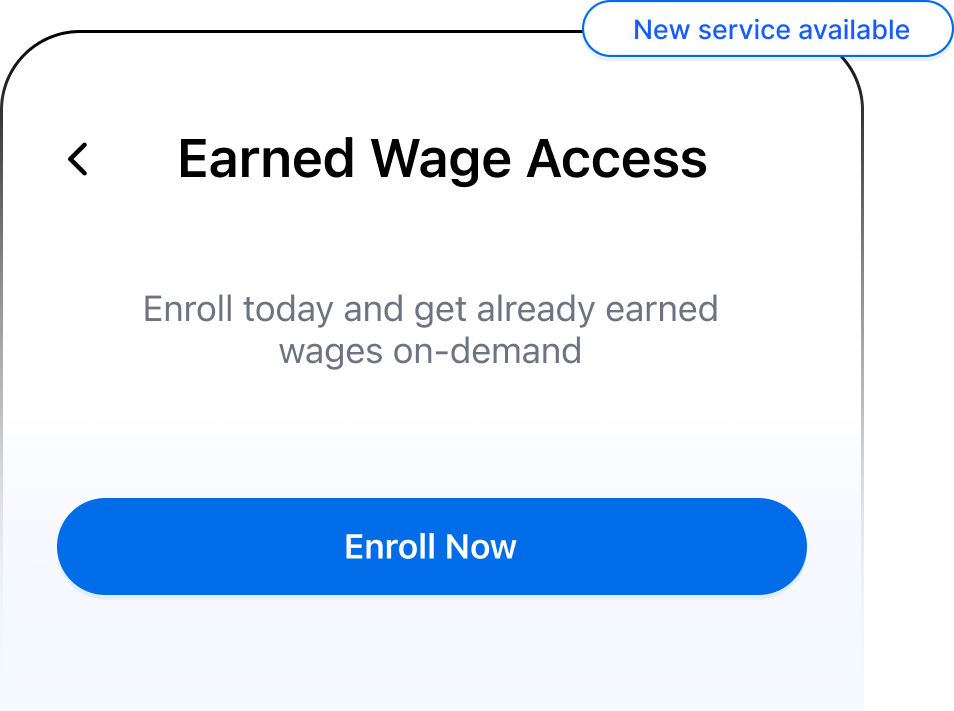

Seamless Enrollment

A fast, intuitive enrollment process with no paperwork or friction. Your consumers will only need their payroll credentials.

3

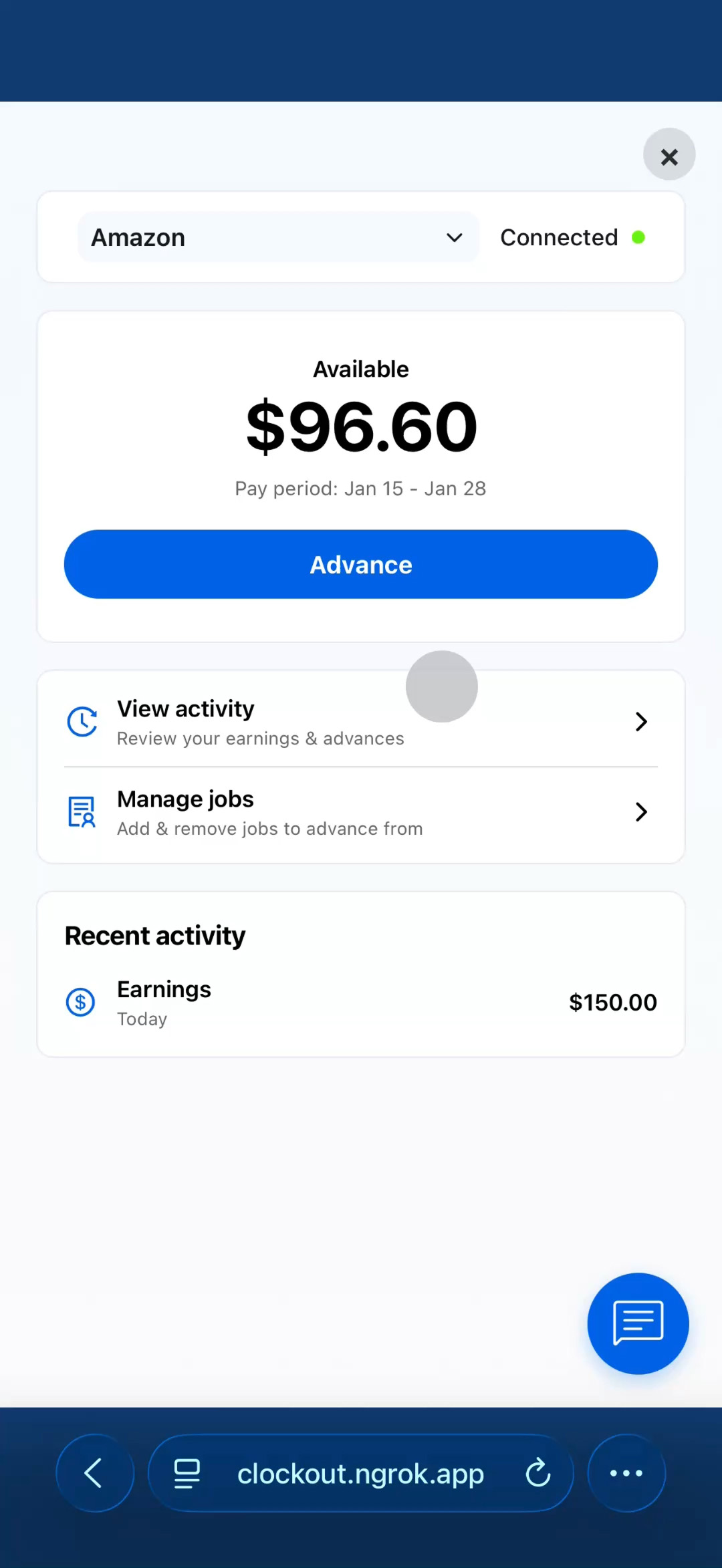

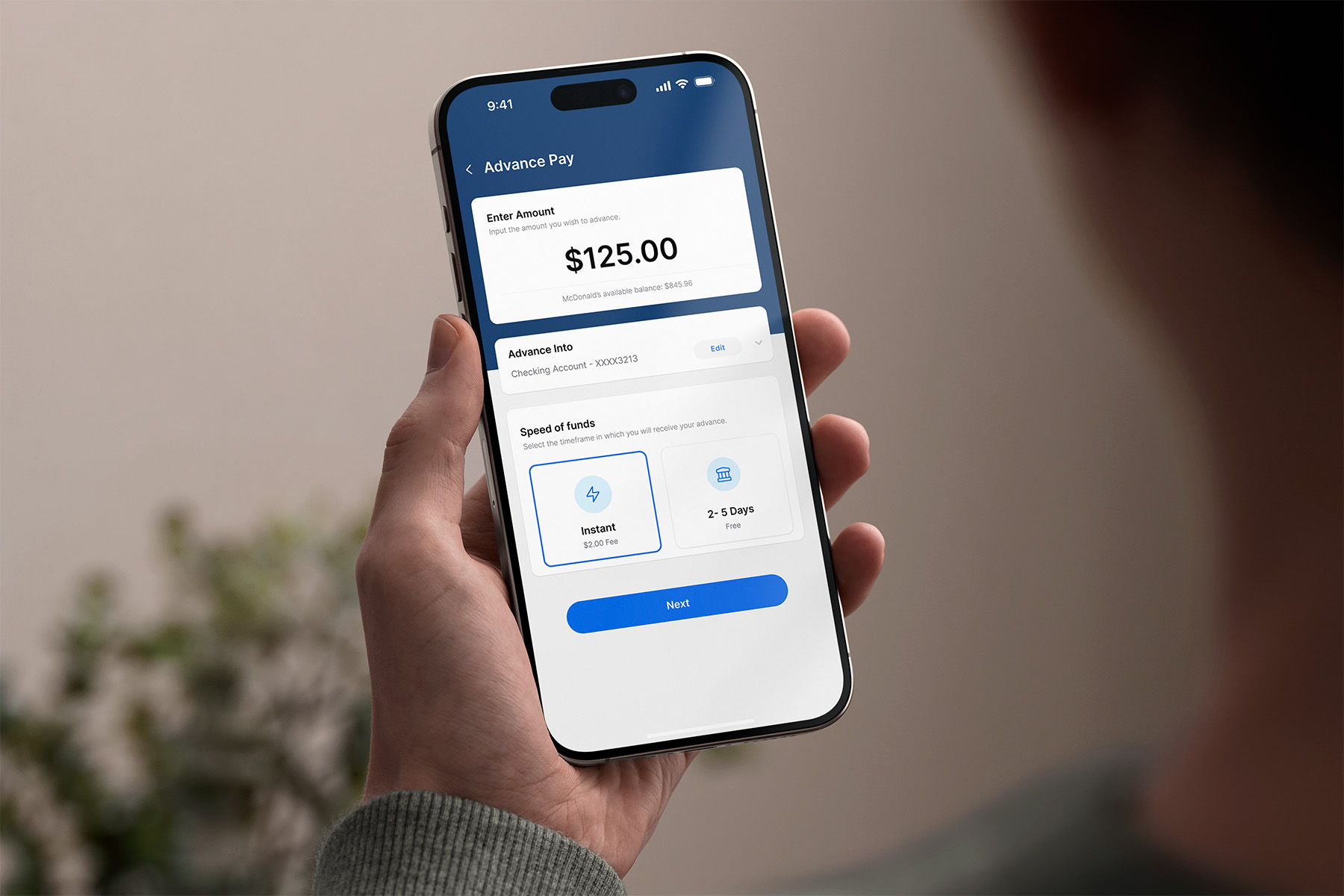

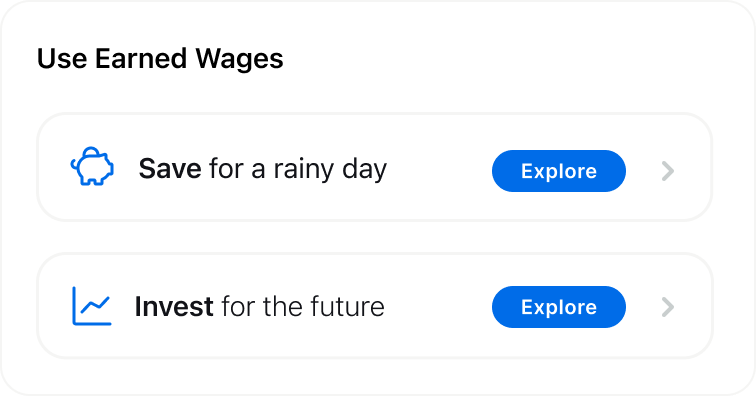

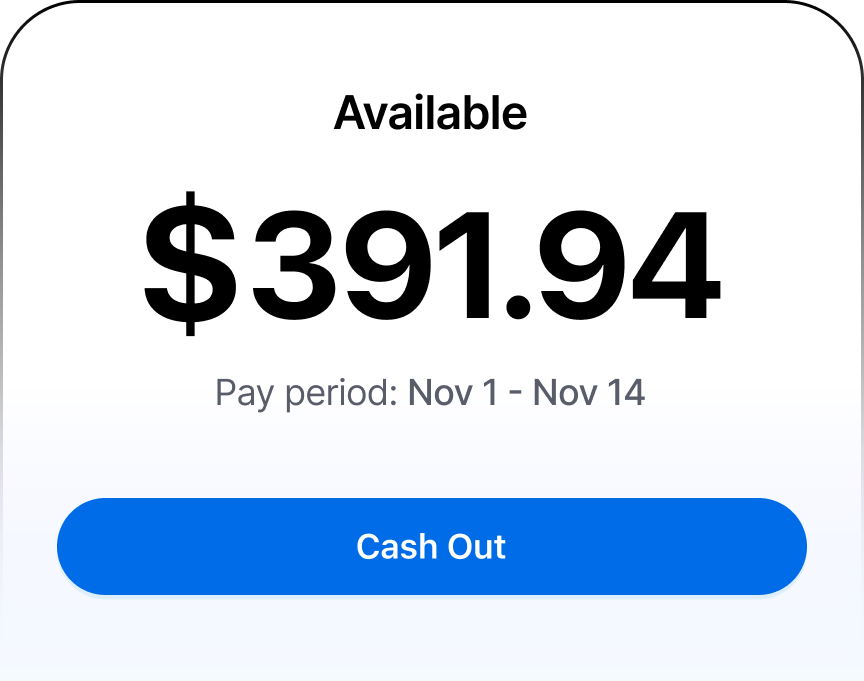

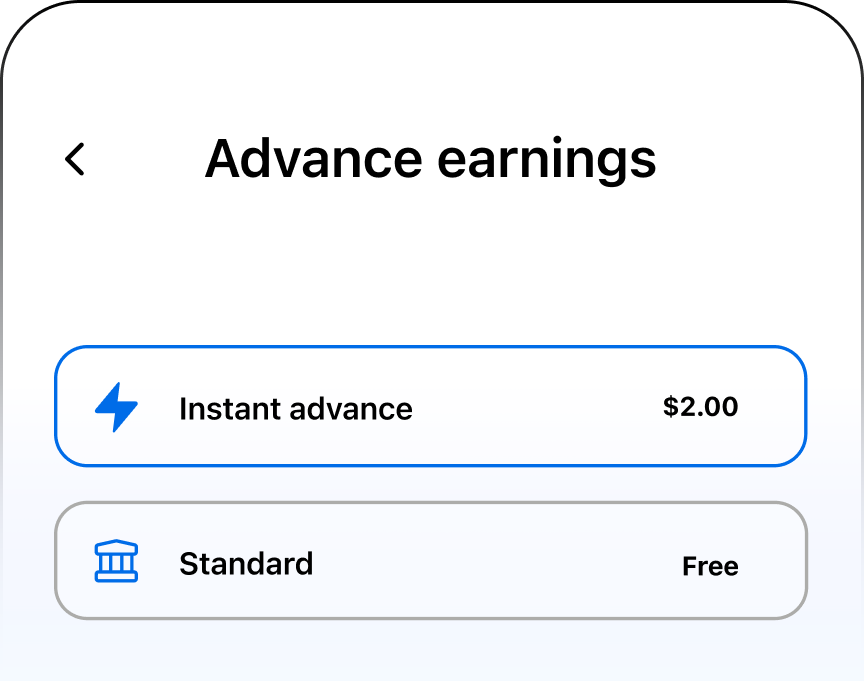

Advance Earnings

Your consumers access a portion of earned wages instantly, without waiting for payday.

4

Track Accounts & Earnings

Your consumers view earnings, advances, and repayment activity in real time here.

Where to find us?

The First Earned Wage Access Solution in Candescent's Marketplace

- Clockout is the pioneering EWA solution available through Candescent

- Leverage Candescent's ecosystem to deploy your Earned Wage Access program rapidly, with pre-built connectors and streamlined onboarding.

- Access dedicated technical resources, comprehensive documentation, and priority support.

Benefits to Financial Institutions

Drive Revenue and Deposits with your Candescent Digital Banking App

Clockout's Candescent integration helps your institution capture Direct Deposits, generate fee income, and deepen consumer relationships.

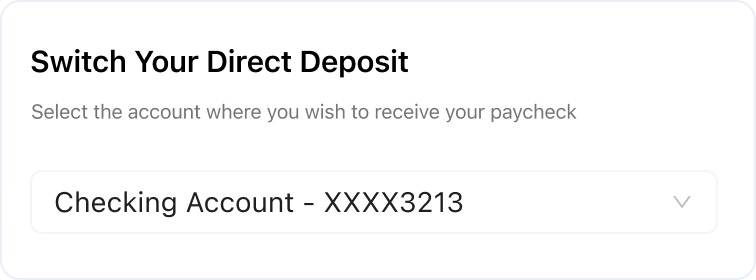

Activate Direct Deposits

Incentivize customers to switch their direct deposits into your bank.

Generate Non-Interest Income

Generate fee-based revenue for every advance your customers make

Cross Sell Products

Incentivize customers to switch their direct deposits into your bank.

Configurations

Your Program, Your Rules - Complete Customization Built In

User Eligibility

Define which consumer segments can access your program. Set criteria based on account age, direct deposit history, balance thresholds, or custom parameters unique to your institution.

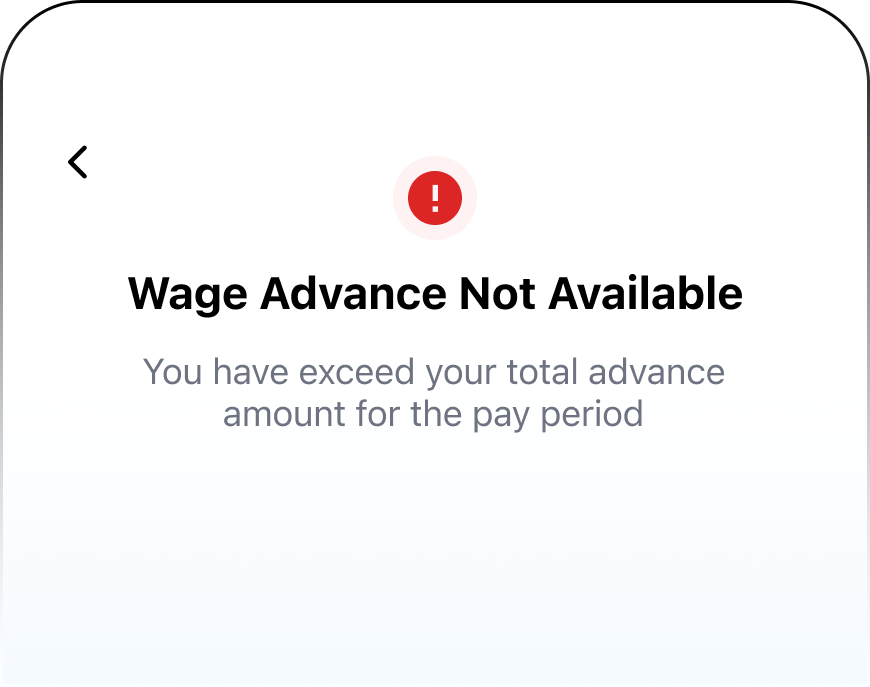

Available Balance

Control available balances with dynamic limits based on custom parameters . Balance customer access with built-in compliant practices.

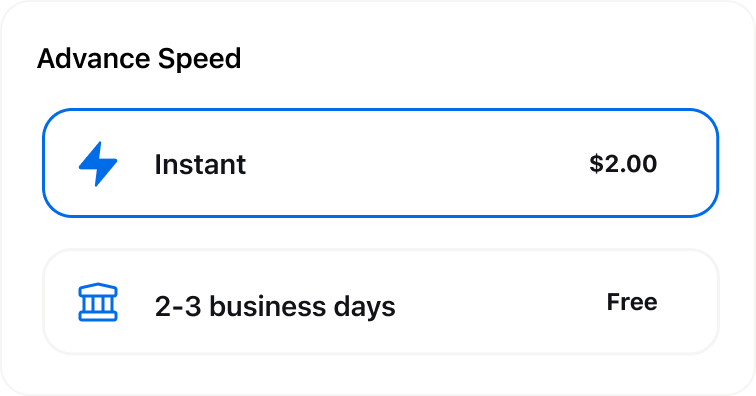

Fee Structure

Design your monetization strategy with per-advance fees or volume-based tiers. Set instant transfers and standard delivery options that align with your pricing philosophy.

Guardrails

Build responsible EWA practices directly into your program rules. Protect consumers with configurable advance limits, cooling-off periods, and usage caps.

Deployment

Deploy Earned Wage Access in your Candescent-Powered App

Our Candescent integration enables your institution to deploy an EWA offering in light speed.

Deploying EWA through Candescent includes

- Fast Setup directly from the Candescent Marketplace.

- 10-14 Week integration into your Candescent mobile app.

- Support to set up and configure your EWA service.

- Marketing assets, and customer support materials.

- Help launching for optimal user adoption.

Experience Our Service

Ready to Launch Earned Wage Access in Candescent?

Join the financial institutions already using Clockout to differentiate their digital banking experience and drive measurable growth in deposits and fee income.

- See a personalized demo of Candescent earned wage access integration

- Receive a custom proposal tailored to your institution's goals

- Get dedicated support from integration through launch

Trusted by leading financial institutions and technology partners